Texas Pacific Land Trust Files Definitive Proxy Statement to Elect Four-Star General Donald G. Cook as Trustee

Urges Shareholders to Vote for General Cook Using the BLUE Proxy Card

Launches Campaign Website www.TrustTPL.com

Business Wire

DALLAS DALLAS — April 8, 2019

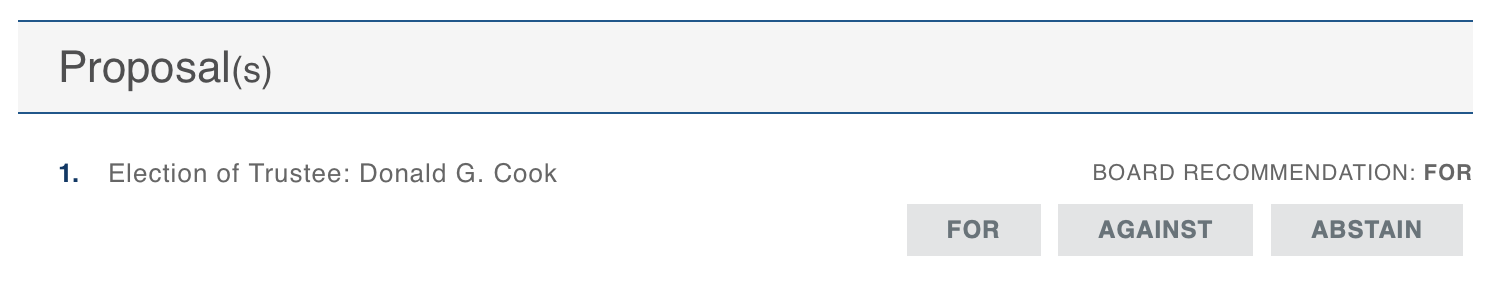

Texas Pacific Land Trust (NYSE:TPL) (the “Trust”) today filed its definitive proxy statement with the U.S. Securities and Exchange Commission (“SEC”) in support of the election of its highly-qualified nominee, retired Four-Star U.S. Air Force General Donald “Don” G. Cook, as Trustee. All votes must be received prior to the closing of polls at the Special Meeting of the shareholders scheduled for May 22, 2019. The Trust’s proxy statement will be mailed to all shareholders, along with the Trust’s BLUE proxy card.

“General Cook has the right experience, knowledge and judgment to help us continue to successfully execute the Trust’s core strategy and evaluate changes to the Trust’s corporate governance,” said Trustee David E. Barry. “We are proud and grateful that General Cook has accepted our nomination. In addition to his extensive public company board and corporate governance experience, shareholders will benefit from his decades of distinguished leadership, including service in numerous command and high-level staff assignments in the U.S. Air Force prior to his retirement in 2005 as a four-star general.”

General Cook was selected by the Trustees following a thorough review of over 15 candidates identified by outside advisors, including Spencer Stuart, one of the world’s leading global executive and board director search firms. Following the Trust’s previous nomination of another candidate with extensive commercial real estate experience to supplement the existing oil & gas expertise, the Trustees have listened to the views of shareholders who expressed a desire for a candidate with deep public company corporate governance experience. In response to shareholders’ feedback, the Trustees have decided to nominate the highly decorated General Cook. General Cook has had extensive experience on multiple public company boards in a range of committee roles, including on the board of Crane Corporation (where he chairs the nominating and governance committee) and on the board of Burlington Northern Santa Fe Railroad prior to its acquisition by Berkshire Hathaway in a $44 billion transaction. General Cook has also been the Chairman of the San Antonio chapter of the National Association of Corporate Directors (NACD), a group recognized as the authority on leading boardroom practices.

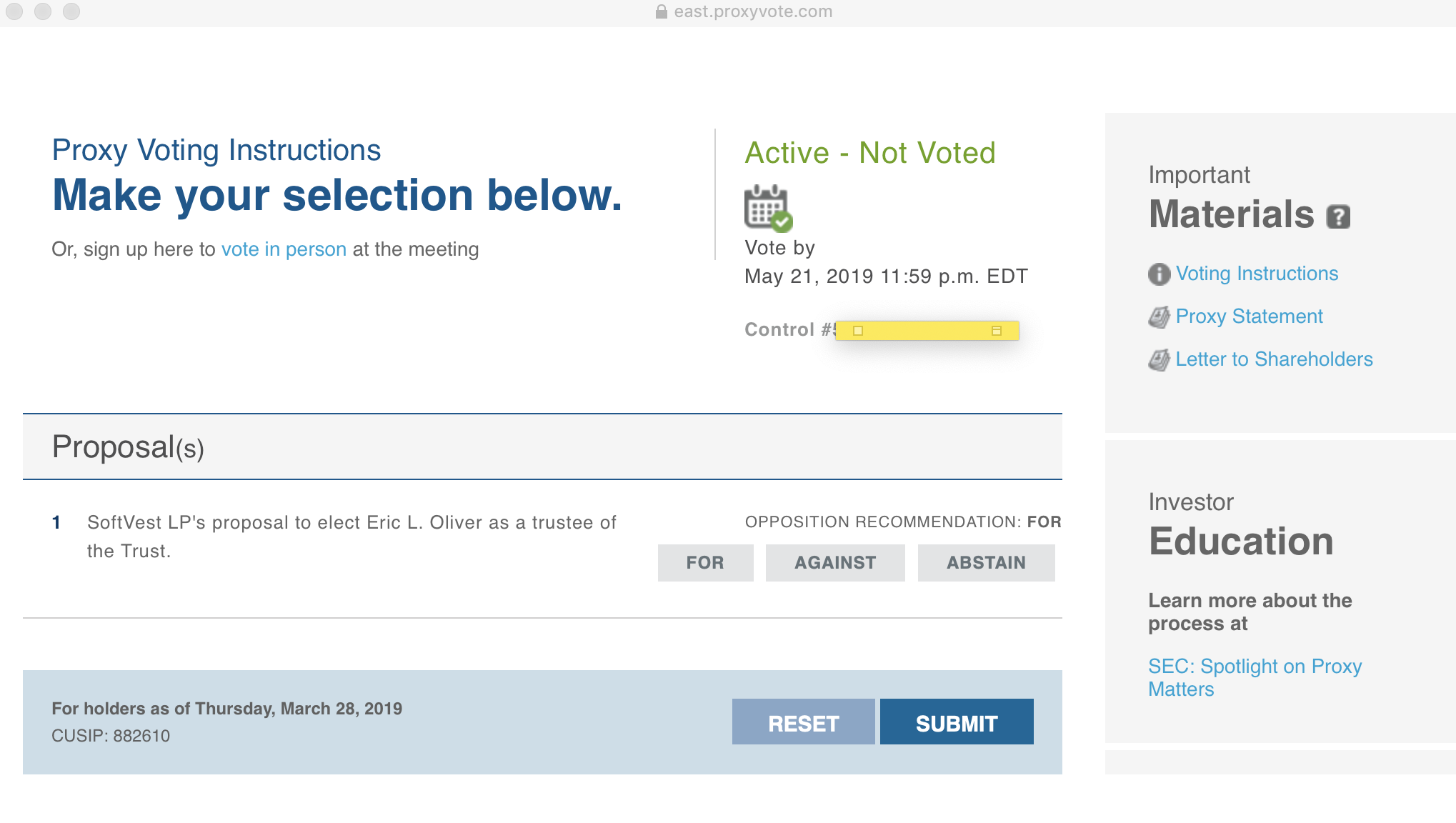

Separately, a group of dissident shareholders has nominated an alternative candidate as Trustee, Mr. Eric Oliver. Prior to nominating General Cook, the Trustees reached out to the dissident group several times and offered to find a mutually acceptable candidate to avoid a costly and distracting proxy contest. Unfortunately, the dissident group declined the Trust’s offer and responded on Saturday that “Eric [Oliver] is the only nominee that Horizon, ART-FGT and SoftVest will vote for.”

Trustee John R. Norris III said, “We appreciate the feedback of our shareholders and have taken their valued input into consideration in identifying General Cook as our nominee. While we have sought to resolve this contest, the dissident group has refused to come to the table and was not even interested in learning the names of potential compromise candidates.”

In connection with the election, the Trust today launched www.TrustTPL.com, a new website dedicated to support the election of General Cook. The site is part of the Trust’s effort to ensure investors have accurate information about why General Cook is the clear choice as Trustee. The website will be updated regularly in response to new developments. The Trust encourages all of its shareholders to review the information available on the website, which also provides information on how shareholders can vote their shares.

Shareholder will receive the Trust’s proxy statement along with a BLUE proxy card in the upcoming days. Shareholders are encouraged to discard any white proxy card distributed by the dissident group. Shareholders with any questions should contact the Trust’s proxy solicitors, MacKenzie Partners at (800) 322-2885 (toll free in the U.S.) or (212) 929-5500. You can also email questions to proxy@mackenziepartners.com.

Stifel is acting as financial advisor, Sidley Austin LLP is acting as legal counsel and MacKenzie Partners is acting as proxy solicitor to the Trust.

About General Donald G. “Don” Cook

General Don Cook, 72, is a retired four-star General of the United States Air Force. General Cook brings to TPL exemplary leadership and corporate governance skills.

General Cook currently serves on the board of Crane Corporation (since 2005), where he chairs the nominating and governance committee and is a member of the compensation and the executive committee, and of Cybernance, Inc. (since 2016). General Cook previously served on the boards of USAA Federal Savings Bank (from 2007 until 2018), U.S. Security Associates Inc., a Goldman Sachs portfolio company (from 2011 to 2018), and Hawker Beechcraft Inc. from (2007 to 2014). Moreover, General Cook served on the board of Burlington Northern Santa Fe Railroad for almost five years until it was sold to Berkshire Hathaway in 2010 in a transaction valued at $44 billion. He also consults for Lockheed Martin Corporation. In addition to his extensive corporate governance experience, General Cook has been the Chairman of the San Antonio chapter of the National Association of Corporate Directors (NACD), a group recognized as the authority on leading boardroom practices.

General Cook had numerous additional command and high-level staff assignments during his 36-year career with the Air Force and retired as a four-star General. He commanded the 20th Air Force (the nation’s nuclear Intercontinental Ballistic Missile force), two space wings, a flying training wing and Air Combat Command during Sept. 11. General Cook served as the Chief of the Senate Liaison Office and on the staff of the House Armed Services Committee in the U.S. House of Representatives. Prior to his retirement from the Air Force in August 2005, General Cook’s culminating assignment was Commander, Air Education and Training Command at Randolph Air Force Base in Texas, where he was responsible for executing the $8 billion annual budget and providing for the leadership, welfare and oversight of 90,000 military and civilian personnel in the command. He was twice awarded the Distinguished Service Medal for exceptional leadership.

General Cook holds a master of business administration (MBA) from Southern Illinois University, as well as a bachelor’s degree from Michigan State University. He is active with several civic organizations in the San Antonio, Texas, community.

About Texas Pacific Land Trust

Texas Pacific Land Trust is one of the largest landowners in the State of Texas with approximately 900,000 acres of land in West Texas. Texas Pacific was organized under a Declaration of Trust to receive and hold title to extensive tracts of land in the State of Texas, previously the property of the Texas and Pacific Railway Company, and to issue transferable Certificates of Proprietary Interest pro rata to the holders of certain debt securities of the Texas and Pacific Railway Company. Texas Pacific’s trustees are empowered under the Declaration of Trust to manage the lands with all the powers of an absolute owner.

Additional Information and Where to Find It

Texas Pacific has filed its definitive proxy statement on Schedule 14A and form of BLUE proxy card with the SEC in connection with the solicitation of proxies for the Special Meeting. Texas Pacific, its trustees and its executive officers are participants in the solicitation of proxies from holders of Texas Pacific sub-share certificates in connection with the matters to be considered at the Trust’s upcoming Special Meeting. Information regarding the names of the Trustees and executive officers and their respective interests in the Trust by security holdings or otherwise is set forth in the Texas Pacific’s definitive proxy statement. HOLDERS OF TEXAS PACIFIC SUB-SHARE CERTIFICATES ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND BLUE PROXY CARD AS THEY CONTAIN IMPORTANT INFORMATION. A free copy of the Texas Pacific’s definitive proxy statement and other relevant documents that Texas Pacific files with the SEC may be obtained through the SEC’s website at www.sec.gov or at Texas Pacific’s website at www.tpltrust.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Forward-Looking Statements

This press release may contain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release, other than statements of historical fact, are “forward-looking statements” for purposes of these provisions, including statements regarding Texas Pacific’s future operations and prospects, the markets for real estate in the areas in which Texas Pacific owns real estate, applicable zoning regulations, the markets for oil and gas, production limits on prorated oil and gas wells authorized by the Railroad Commission of Texas, expected competitions, management’s intent, beliefs or current expectations with respect to Texas Pacific’s future financial performance and other matters. Texas Pacific cautions readers that various factors could cause its actual financial and operational results to differ materially from those indicated by forward-looking statements made from time-to-time in news releases, reports, proxy statements and other written communications, as well as oral statements made from time to time by representatives of Texas Pacific. The following factors, as well as any other cautionary language included in this press release, provide examples of risks, uncertainties and events beyond our control that may cause Texas Pacific’s actual results to differ materially from the expectations Texas Pacific describes in such forward-looking statements: global economic conditions; market prices of oil and gas; the demand for water services by operators in the Permian Basin; the impact of government regulation; the impact of competition; the continued service of key management personnel; and other risks and uncertainties disclosed in Texas Pacific’s annual reports on Form 10-K and quarterly reports on Form 10-Q. We undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or other factors that affect the subject of these statements, except where we are expressly required to do so by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190408005408/en/

Contact:Media:

Abernathy MacGregor

Sydney Isaacs

(713) 343-0427

sri@abmac.com

Investor Relations:

MacKenzie Partners

Paul Schulman / David Whissel

(212) 929-5500 or (800) 322-2885

pschulman@mackenziepartners.com

-0- Apr/08/2019 11:22 GMT