Big volume day today. Ranked #4 for total market value traded.

Big volume day today. Ranked #4 for total market value traded.

Strong! Some land swapping reported.

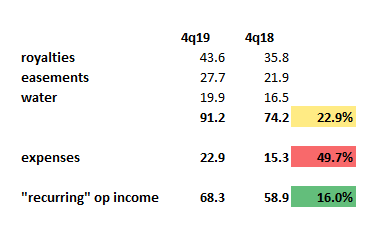

The Trust reported net income of $71.3 million for the fourth quarter ended December 31, 2019, an increase of 13.8% over net income of $62.7 million for the fourth quarter ended December 31, 2018. The increase was principally related to increased oil and gas royalties, easements and other surface-related income and water sales.

In an exchange transaction, the Trust conveyed approximately 5,620 acres of land in exchange for approximately 5,545 acres of land, all in Culberson County. As the Trust had no cost basis in the land conveyed, the Trust recognized land sales revenue of $22.0 million for the fourth quarter ended December 31, 2019.

Back of the envelope I see a 23% increase in non-sale earnings and a 50% increase in expenses. Non-sale operating income is up 16%.

Looks to be about $40/share in cash on the balance sheet. Cash on the balance sheet is equivalent to ~5.5% of the market cap @ $726.50/share.

You may know the author of this letter/Woodlock founder, Christopher Mayer, from the book 100 Baggers: Stocks That Return 100-to-1 and How To Find Them. I read 100 Baggers by the lake this summer and found it entertaining, eduational, and inspiring. Still waiting for my own 100 bagger tough…

https://www.woodlockhousefamilycapital.com/post/woodlock-house-q4-letter

Texas Pacific Land Trust (NYSE:TPL)

Cheap: Acquired at a discount of at least 20% to a growing net asset value

Owner-operator: Horizon Kinetics owns nearly one quarter of the shares

Disclosures: Improving as part of Horizon’s campaign

Excellent financial condition: Debt-free

Texas Pacific Land Trust has been one of the best performing stocks of the last 20 years, returning 17% annually. The Trust dates to 1888 and formed part of the land holdings of the old Texas & Pacific Railroad. It is the largest landowner in the state of Texas. And it was lucky to have its land in the heart of the Permian Basin in West Texas.

The Permian is one of the richest oil resources in the world. Nearly half of US oil production comes from the Permian. All the big players are at work here – especially Exxon (NYSE:XOM), Chevron (NYSE:CVX) and Occidental (NYSE:OXY).

TPL owns “non-participating perpetual royalty interests” (NPRIs) in about 460,000 acres. NPRIs entitle TPL to a perpetual right to receive a fixed cost-free percentage of production revenue. TPL also charges users for easements – for pipelines, work crews, roadway rights, power lines, storage facilities, etc. Since its land covers such a large area, almost any infrastructure project will cross TPL land.

Finally, TPL controls the water rights to these acres. As drilling is water intensive, this creates an opportunity for TPL to charge for access to its aquifers and for water recycling. TLP created Texas Pacific Water Resources in 2017 to meet this demand.

TPL came on our radar after a near 30% decline from a high of ~$900 in April. I had been following the story casually through Horizon Kinetics, who owns about a quarter of the shares and is involved in a case against the trustees to convert TPL to a C corp. and improve disclosures and governance. (This seems to be going well. On December 4, TPL announced the case for converting to a C corp. was “compelling.”)

The company also continues to report strong results. I would highlight in particular the $32 earned per share (or unit) for 9 months. TPL is on pace to do $42 per share in earnings. At $650 per share, the stock trades for about 15x estimated 2019 earnings. This for a fast-growing company with a 66% net margin (for 9 months) and no debt… Using a variety of valuation methodologies, TPL is worth at least $900 per share and growing.

We picked up shares at an average cost of $645 and the stock is already 20% higher. TPL has a wonderful business model and earns high returns on its assets, exceeding 100%. It is a way to own real assets but by skimming off the cream.

TPL is another cannibal of its own shares. It’s retired 8.5% of its stock since 2014. With Horizon’s involvement, I expect future free cash flow will reduce the share count further.

https://horizonkinetics.com/wp-content/uploads/Q4-2019-Horizon-Kinetics-Commentary_FINAL.pdf

It is true, nothing much has changed so far. For better or worse, that could probably be said about most of the stocks we own at some point during the time we’ve held them. Even the very successful ones. There have been periods measuring in years during the time we’ve held Texas Pacific Land Trust (“TPL”) when nothing had changed. Lately, of course, there have been ongoing changes at TPL. It is probably common knowledge, now, but can’t not be mentioned, that last week the Conversion Exploration Committee announced that it had arrived at its much awaited conclusion. The Committee unanimously recommended to the Trustees of TPL that the Trust convert to a Delaware C-corp. That recommendation was made with the input of Credit Suisse as outside financial advisor as well as outside legal counsel. It should not escape notice that the Trustees are, in fact, on the Committee, so I suppose they took part in formally notifying

themselves.The Committee also recommended that if such a conversion takes place, it should be structured so as to be a tax-free transaction to shareholders. Such changes require the customary regulatory filings and approvals, such as with and by the SEC and NYSE. No doubt, we’ll be hearing more in the coming weeks, since the Committee chose to extend its term for one more month, through the end of February. It could as easily have made it two months or three.

Despite the media narrative, the majors are still very much into shale expansion.

Will Burton, vice president, midstream operations said that what’s different about the company’s Permian Basin presence is the significant investment it plans.

The first step is building up the company’s midstream infrastructure, expanding the midstream assets the company acquired from BHP, Burton said. While declining to provide a specific amount, he said the company is making significant capital expenditures in infrastructure, including pipeline and gathering lines for gas, oil and water and nine central delivery points with adjoining water disposal facilities.

The first central delivery point is currently under construction in the Orla region of Reeves County. The first two are expected to be completed by the end of the year, at which time BPX will begin ramping up its drilling operations later and carrying through the next four to six years, Burton said.

Okay, there’s a couple of questions on TPL. I’m going to read them, and then I’m going to answer them in generalized ways, because some of the news is actually out and some of it I just can’t say, but two questions, are you able to work with the present trustees a bit of TPL? Well, and then secondarily it’s related question, will the corporate conversion happen?

Well to the latter, you might have observed the SEC filing on TPL. I believe it was Wednesday. Yesterday, you can see, so you can read it for yourselves, but the committee recommended the conversion, and you can see what’s going on there.

And I think that document answers the first question, because I think, I hope you could read that in the document. I thought everybody was working very well together or at least it strikes me that’s what the document should say, because I think it reads very well, but I leave it to you to judge for yourself. Anyway, the information is out there. You can read it and that’s the way it is. Okay, next question?

OK. I’ll take it.

The decision of whether to convert TPL into a c-corporation is subject to determination of the current Trustees. The Committee recommended that, if the Trustees elect to authorize the conversion, the conversion should follow a process intended to ensure a smooth transition that would be tax-free to shareholders. As proposed, TPL would transfer all its assets, including cash, land, Texas Pacific Water Resources, and other assets, to a wholly-owned limited liability company subsidiary of TPL (“TPL Holdco”). TPL would then contribute all of the equity in TPL Holdco, holding all of TPL’s assets, to a newly-created corporation (“TPL Corporation”). Current shareholders of the Trust would receive an amount of shares in TPL Corporation proportional to their ownership of shares in the Trust. When this process as recommended is completed, shares of the Trust would be cancelled. Shareholders of the Trust would not need to take any action to receive the new shares in TPL Corporation.

Great opportunity to split the new shares too. Would be amazing/horrifying if the Trustees went rogue and decided not to adopt. Given all we’ve been through I wouldn’t be surprised. That certainly isn’t the base case though.

Some folks were wondering about a unit holder vote to convert. That doesn’t appear to be the case.

Much remains unsaid about governance of the new entity. Also not mentioned is the plan for returning accumulated cash and cash going forward.

The shale boom transformed the Permian from an overlooked backwater into the world’s hottest drilling region. But many producers there have delivered little in the way of returns for investors as companies put all their revenue back into new wells to boost output. Texas Pacific has bucked that trend.

“We believe TPL is the best single ETF to own for Permian exposure,” Stifel said.

The downside of buying now is that others have already noticed Texas Pacific’s attributes. The stock has soared 569% in the past four years, far outpacing oil prices.

Stifel has initated coverage with a price target of $937. Rated “new buy”.

https://thefly.com/landingPageNews.php?id=3014981&headline=TPL-Texas-Pacific-Land-Trust-initiated-

Diversifying the revenue base. Does TPL get a royalty on the power produced?

RWE has started commercial operations at its 100MW West of the Pecos solar farm in Texas.

The project is located on 283 hectares of land in Reeves County leased from Texas Pacific Land Trust and Texas General Land Office.

It comprises nearly 350,000 solar modules and is RWE’s first photovoltaic project in Texas.

West of the Pecos has a long-term power purchase agreement with SK E&S LNG for 50MW of the output.

Located 75miles (120.7km) southwest of Midland-Odessa, the solar plant is spread across on more than 700 acres of land leased from Texas Pacific Land Trust and Texas General Land Office within the county and is powered by nearly 350,000 solar modules.

RWE Renewables CEO Anja-Isabel Dotzenrath said: “The completion of our largest solar project in the U.S. is another good example of RWE’s continued success in the U.S. market and our effort to diversify our portfolio across technologies. With a development pipeline of more than 10 GW our strategy for renewables in the U.S. is geared for growth.

“A very big thank you to all involved employees and partners, who made an excellent job in the smooth execution of this project. West of the Pecos underscores our commitment to being the partner of choice for the transition to a lower-carbon future.”

Nice find here from John, a reader of the blog. Good one for the archives.

https://www.youtube.com/watch?v=2MHIcabnjrA&feature=youtu.be&t=4638

Mr. Buffett argues that it not realistic to value real estate holding companies at the grossed up price of their last fractional/marginal sale. Hard to disagree. What we are seeing now, in my opinion, is the market paying attention to the top and bottom lines of the income statement.

What’s the max?

https://kineticsfunds.com/funds/small-cap-opportunities-fund/commentary

We believe that many of the core positions in the Fund are actually both true growth and value investments. As an example, Texas Pacific Land Trust has grown sales and net income at a 50% compound annual rate over the trailing five years. A statistical review might conclude that this is a “reasonably priced” growth stock, trading at approximately 16.5x trailing earnings over the past twelve months. However, this earnings figure includes a sizeable one‐time land sale and is not directly relevant to the run‐rate cash flow of the business. That being said, a bottom‐up valuation of the company’s land portfolio and related oil and gas, easement and water businesses suggests a substantial discount to net asset value, given that less than 10% of the company’s core assets have been exploited to date.

Thanks to Gary for this link!