Rude and crude analysis warning. I was looking at 4Q and was thinking that net income looked fairly light relative to revenue so I did a little digging and confirmed my suspicion.

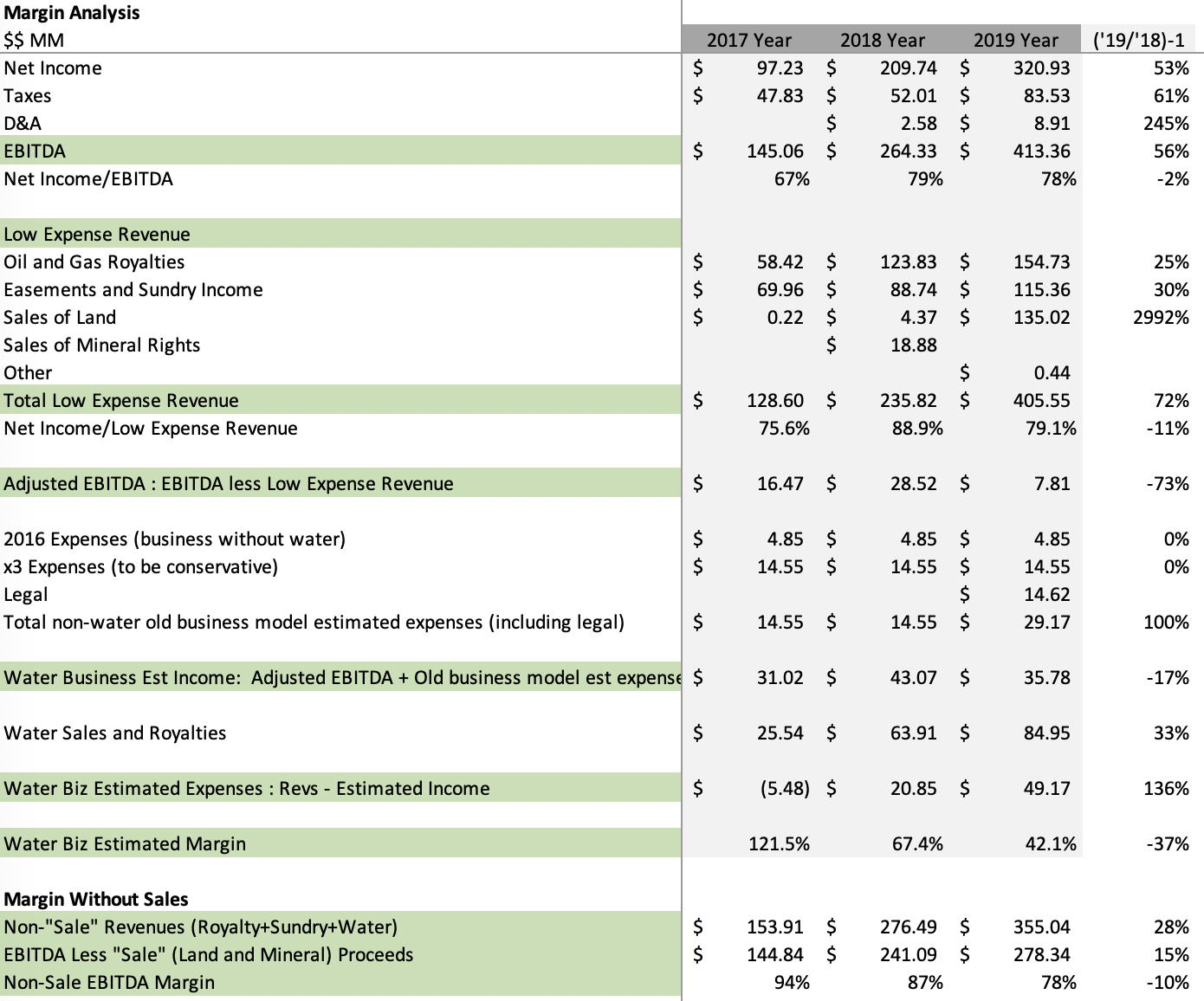

The top analysis attempts to isolate the water business to determine profitability. We start with net income and add taxes back in to get an EBT. EBT is then reduced by TPL’s legacy “low expense” businesses (Royalty, Sundry, and Sales) to get towards earnings from the water business. This new adjusted EBT number is further adjusted by adding back an estimate for the expenses (2x 2016 full year expenses) of the “low expense” businesses. The result is something that might approximate income generated by the Water business. Water’s reported top line can be compared to the water income estimate to get a picture of what Water’s expenses and margin look like.

The conclusion is that Water’s expenses were up significantly in 4Q which drove the estimated margin down to ~21%. Lots of assumptions and brute force in here. Everything highlighted in green is a custom creation.

The bottom analysis gets to ongoing margins more directly. Here we compile the revenues from Royalty, Sundry, and Water and compare them to a “non-sale” income number that is generated by adding taxes and proceeds from asset sales back into net income. Adjusted income / adjusted sales = margin of repeating buiness. This analysis too points to materially lower margins in 4Q.

Where’s that margin going?

Update: Quick update 15 minutes after posting. Please take some time to look at the column all the way to the right. Margin compression or not, $TPL is on fire. Oh, and thank you Mr. Taxman.