I was present in the courtroom today. A few things I learned…

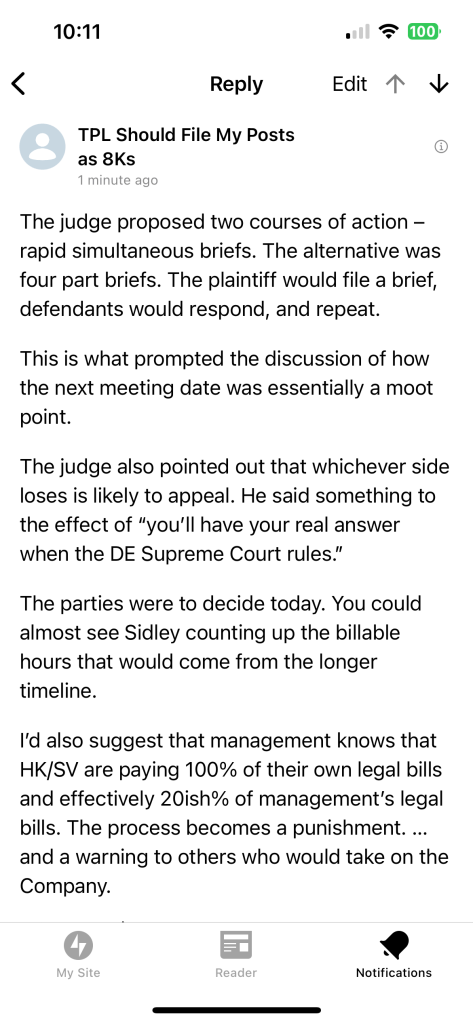

First, do not expect a ruling any time soon. The parties will decide how to do post-trial briefs for the judge tomorrow. That will impact if those briefs are done before the next scheduled meeting.

The judge seemed to indicate that the future meeting would be a moot point. If he rules for TPL, then Prop 4 will effectively be deemed passed. If he rules for HK/SV, then Prop 4 is effectively dead.

The judge also seemed to think the date of record currently set for voting on the proposal was too far in the past. However, the point is likely moot based on either ruling.

My hunch is that the judge is inclined to rule for HK/SV. However, he will be mindful of any precedent that a ruling could set for broader Delaware Corporate law. I suspect he will look for a narrow issue that allows him to rule for HK/SV that does not have broader implications.

***

A few things I’ve learned: TPL has spent north of $6, probably closer to $10 million of shareholder money on litigation.

TPL – through its law firm, Sidley Austin – hired a private investigator to determine if Lion Long Term Partners colluded with HK/SV in releasing its pre-vote statement.

The courtroom was over capacity. A reporter for Bloomberg Law said she has never seen so many shareholders appear in person. No shareholders present indicated support for TPL management.

This was probably the first time in years people were sitting on the floor in the Delaware Chancery Court. The floor and benches do not appear to offer different levels of comfort.

The judge referenced the crime-fraud exception to pierce attorney-client privilege TPL asserted on one its documents.

The statement in question was in a proxy statement: “The Company currently does not currently have sufficient shares available for issuance to meet its existing obligations. We are concerned that the Company is unable to meet its current and potential obligations and believe it is important that the Company obtain additional common shares available for issuance in the future.”

Director Karl Kurz testified that the quote in the proxy did not appear to be accurate. TPL’s lawyers tried to rehabilitate this later.

EO and MS were excellent witnesses. (Humorosly they were quite a contrast. New York HK and West Texas EO.)

The TPL lawyers, at times, came across like high school mock trial participants. They seemed to be trying to create drama and theatrics where none existed.

TPL management does not appear to be a fan of the TPLT Blog. (Ty, Michael, John & David – nice to meet you via blog. I wish it hadn’t come to this.)

My hunch has been that management wants to do an acquisition to dilute HK/SV. Nothing I saw today has changed my opinion.

The trial also convinced me that no one knows TPL better than EO. He and MS are genius-level folks. It had to be unnerving for opposing counsel to be in a situation where the witness was clearly more intelligent than the lawyer asking the question. That’s not something you see all the time.

By my count there were around 25 attorneys and paralegals there on behalf of TPL. And, as shareholders, we are collectively paying for them to sue the majority of voters.

The expert witness testimony led me to believe this is not a slam-dunk case. Clearly I think HK/SV should win. However, the judge will be thinking about more than just this case. There’s a reason companies choose Delaware. This is why I suspect he will find a narrow point that favors HK/SV and use that rather than staking out new law.

***

As TPL shareholders we all owe MS & EO a debt of gratitude for spending the huge amounts of money to fight this fight. While they have their own reasons, everyday retail investors are free-riders on their dime.